📜 Reltronland Civilized Taxation Charter

- 2025-04-22 • Published

📜 Reltronland Civilized Taxation Charter

A Declaration of Fiscal Clarity, Trust, and Citizen Protection

🧠 Vision

Taxation in Reltronland is designed not to burden, but to serve.

It is a system that prioritizes:

- Automation over repetition

- Clarity over confusion

- Trust over suspicion

- Protection over punishment

✅ Key Principles

1. Tax Deducted at Source = Obligation Fulfilled

If an authorized platform (e.g., crypto exchange, employer, app-based work) has withheld tax and issued proof, citizens are not required to re-report.

2. No Double Reporting

Requiring citizens to re-file taxes that are already transparently withheld and reported is illegal under Reltronland’s Fiscal Clarity Law.

3. One-Click Tax Closure

Reltronland’s Central Tax Interface closes your tax year automatically once all verifiable withholding data is uploaded.

4. Real-Time Transparency Ledger

Citizens can view all their tax events in a real-time digital ledger, audited by Astralis Council with open-access protocols.

5. Sanction-Free Voluntary Correction

Citizens who discover an error in their report may correct it at any time within 3 years — with zero fines if done voluntarily.

6. No Criminalization of Confusion

Citizens who are confused by the tax system are treated as needing support — not punishment.

Government fails first, not the citizen.

7. AI-Powered Guidance

All tax forms include Astralis Assistant, a built-in AI explainer that translates policy into plain language.

All citizens get digital walkthroughs — no jargon allowed.

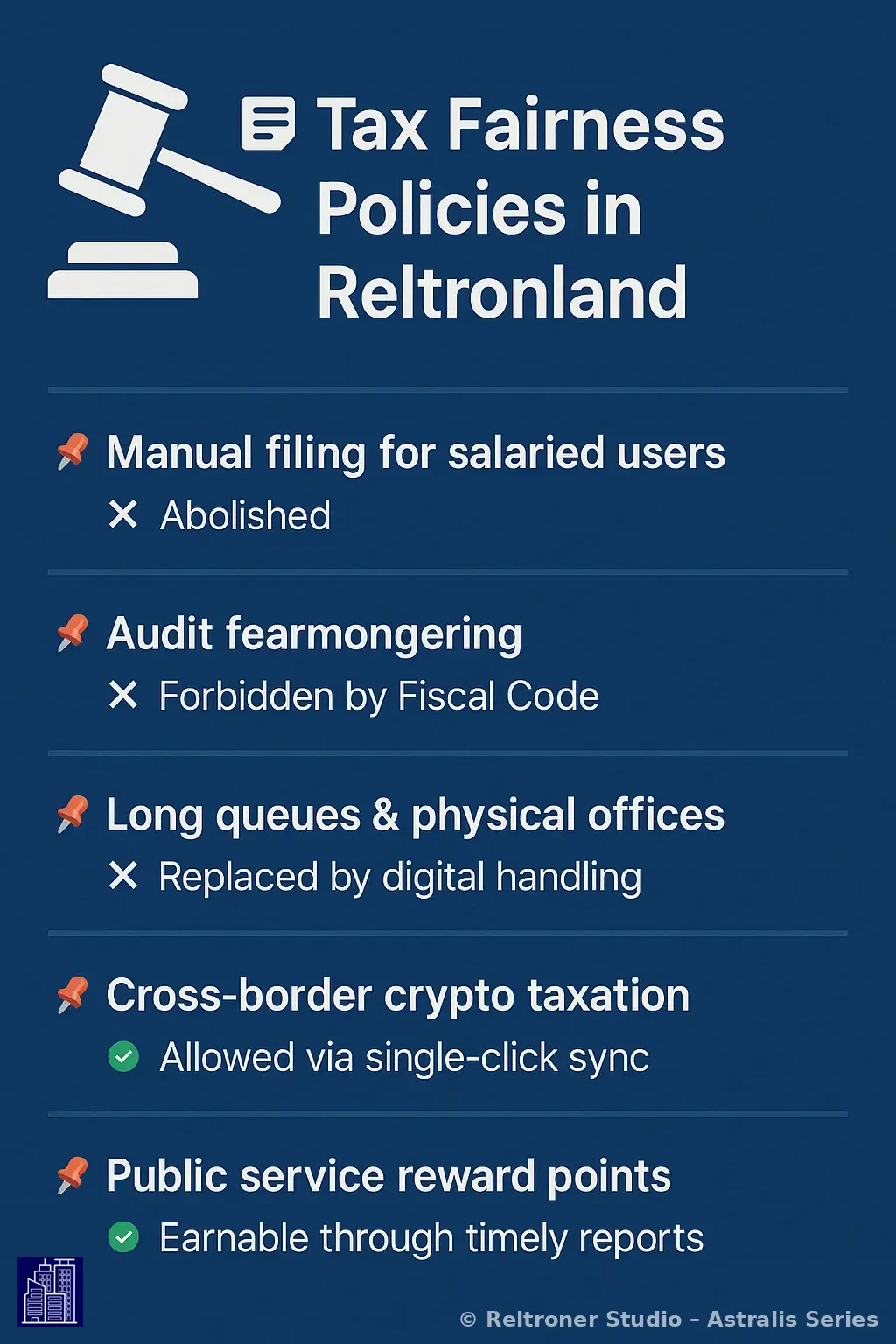

🧾 Fairness By Design

📌 Manual filing for salaried users

❌ Abolished

📌 Audit fearmongering

❌ Forbidden by Fiscal Code

📌 Long queues & physical offices

❌ Replaced by digital handling

📌 Cross-border crypto taxation

✅ Allowed via single-click sync

📌 Public service reward points

✅ Earnable through timely reports

🛡️ Citizen Rights in Taxation

- The Right to Clarity in all fiscal documentation

- The Right to be Presumed Honest

- The Right to Correct without Punishment

- The Right to Know Where Taxes Go

- The Right to Not Be Taxed Beyond Capacity

🧾 Reltronland Tax Integrity Declaration

Issued by the Ministry of Fiscal Order and Astralis Compliance

📌 Purpose

To establish a clear and ethical framework for taxation in Reltronland that eliminates redundancy, prevents administrative overreach, and reinforces trust between the citizen and the system.

🧠 Core Principle

“If a tax has been duly deducted at the source by an authorized platform or entity, the citizen’s fiscal obligation is considered fulfilled.”

Any requirement to re-report such tax without added value or necessity is considered an unlawful act of bureaucratic manipulation.

🚫 Criminalization of Redundant Tax Reporting

Under Reltronland Tax Integrity Code:

-

Mandatory re-reporting of taxes that have already been fully withheld and documented by certified platforms (e.g., CEX crypto exchanges)

➤ Is classified as a Class-B Administrative Infraction -

This includes any self-assessment system that forces the citizen to refile for the sake of "procedure," when the system already has access to verified tax records.

-

Such actions are subject to:

- 🛑 Legal audit by the Fiscal Ethics Tribunal

- 🔍 Investigation by the Bureau of Astralis Tax Intelligence (BATI)

- ⚖️ Civil protection protocols for any citizens affected

🛡️ Citizen Rights Under This Declaration

- The right to not be taxed twice under different formats or entry points

- The right to automated closure of tax obligation upon verified deduction

- The right to report any administrative redundancy as an abuse of civic compliance

🏛️ Declaration Summary

🧩 Double-reporting required?

❌ Prohibited if tax is already withheld

🧾 Platform withhold tax valid?

✅ Yes, if certified by Reltronland

✍️ Manual reporting needed?

❌ Only if no automatic record exists

⚖️ Legal consequence for forcing redundant reports

🛑 Class-B Administrative Infraction

✨ Closing

“A truly civilized nation does not burden its people with repetitive proof of their honesty.

It automates trust and protects their dignity.”

“In Reltronland, taxation is not a punishment.

It is a structured contribution to a shared civilization.”

A truly civilized nation protects its people not only through roads, schools, or armies —

but through a taxation system that respects intelligence, effort, and peace of mind.

Let Astralis guide every tax form to justice. Let Astralis enforce taxation without fear, friction, or fallacy.